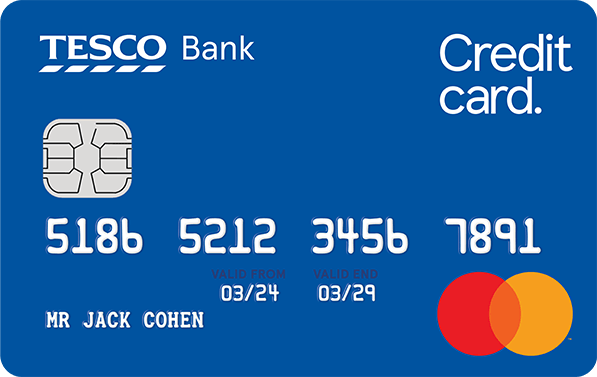

Tesco Bank All Round Credit Card

The Tesco Bank All Round Credit Card is a versatile financial product that offers rewards on all purchases, making it an attractive option for those seeking a flexible credit solution.

This card is designed to be an all-in-one solution, allowing users to make balance transfers and money transfers, as well as spread the cost of large purchases over time.

With its range of features, the Tesco Bank All Round Credit Card is ideal for individuals looking for a credit card that can adapt to their financial needs.

Key Takeaways

- Earn rewards on all your spending with the Tesco Bank All Round Credit Card.

- Make balance transfers and money transfers with ease.

- Spread the cost of large purchases over time.

- A versatile financial product suitable for various credit needs.

- An all-in-one solution for your financial requirements.

Overview of the Tesco Bank All Round Credit Card

Tesco Bank’s All Round Credit Card provides a versatile financial tool that combines 0% interest on purchases and balance transfers with a rewarding Clubcard points system. This card is designed to cater to a wide range of financial needs, making it an attractive option for UK residents.

Key Features and Benefits

The Tesco Bank All Round Credit Card offers several key features that make it stand out. Some of the main benefits include:

- 0% interest on purchases and balance transfers for 14 months, allowing cardholders to manage their finances effectively without incurring additional interest charges.

- The ability to earn Clubcard points on purchases, which can be redeemed for rewards, providing an added incentive for using the card for daily expenses.

A comparison of the card’s features is summarised in the table below:

| Feature | Benefit |

|---|---|

| 0% interest on purchases | No interest for 14 months |

| 0% interest on balance transfers | No interest for 14 months |

| Clubcard points | Earn points on purchases |

Eligibility Criteria

To be eligible for the Tesco Bank All Round Credit Card, applicants must meet certain criteria:

- Be a UK resident.

- Be aged 18 or over.

Meeting these eligibility criteria is crucial for a successful application.

Application Process

The application process for the Tesco Bank All Round Credit Card is straightforward and can be completed online in just 10 minutes. Applicants will need to provide personal and financial information to facilitate the application.

Upon submission, Tesco Bank will review the application and notify the applicant of the decision. The simplicity and speed of the application process make it convenient for potential cardholders.

Interest Rates and Fees

Understanding the interest rates and fees of the Tesco Bank All Round Credit Card is vital for managing your finances effectively. When you have a credit card, it’s not just about making purchases; it’s also about understanding the costs associated with borrowing money.

Annual Percentage Rate (APR) Explained

The representative APR for the Tesco Bank All Round Credit Card is 24.9% (variable). This rate applies to purchases and balance transfers if you’re not within a promotional period. The APR is the interest rate charged on your outstanding balance when you don’t pay your bill in full each month. It’s essential to understand that the APR can change, and it’s a crucial factor in determining how much you’ll owe if you carry a balance.

The APR is calculated on a daily basis, and it’s applied to your outstanding balance at the end of the billing cycle. To avoid interest charges, it’s advisable to pay your balance in full each month. If you’re unable to do so, making more than the minimum payment can help reduce the amount of interest you owe.

Understanding Balance Transfers

The Tesco Bank All Round Credit Card offers a 0% interest rate on balance transfers for 14 months, with a 2.49% transfer fee. This can be an attractive option if you’re looking to consolidate debt from other credit cards or take advantage of the interest-free period to pay off your balance.

To make the most of this offer, it’s crucial to understand the terms. The balance transfer fee is calculated based on the amount you transfer. For example, transferring £1,000 would incur a fee of £24.90. Additionally, the 0% interest rate is promotional and will revert to the standard APR after 14 months if the balance isn’t paid off.

Fees Associated with the Card

Apart from interest rates, there are other fees to be aware of. For instance, cash withdrawals incur a fee, typically a percentage of the withdrawn amount, and are subject to interest at the cash advance rate from the date of withdrawal. Similarly, foreign transactions may attract a fee, usually a percentage of the transaction amount.

It’s also worth noting that late payment fees can be charged if you miss your payment deadline. To avoid these fees, setting up a direct debit is recommended, ensuring your payments are made on time.

Rewards and Cashback Program

The Tesco Bank All Round Credit Card offers a rewarding experience through its integration with the Tesco Clubcard rewards program. This program is designed to reward customers for their purchases, both online and in-store, providing a valuable way to earn points that can be redeemed for rewards.

How the Tesco Clubcard Works

The Tesco Clubcard is a rewards program that allows customers to earn points on their purchases from Tesco and other partner retailers. When using the Tesco Bank All Round Credit Card, customers earn points that are automatically added to their Clubcard account.

Earning points is straightforward: for every pound spent on eligible purchases, customers earn 1 Clubcard point.

Earning Points on Purchases

Customers can earn points on a wide range of purchases, including groceries, fuel, and other items bought at Tesco or with Tesco’s partners. The Tesco Bank All Round Credit Card enhances this by offering additional points on certain categories, such as fuel purchases.

For example, customers can earn extra points when they buy fuel at Tesco petrol stations, making it a rewarding choice for daily commutes.

Redemption Options for Rewards

Once customers have accumulated points, they can redeem them for a variety of rewards. These include vouchers that can be used in Tesco stores, online shopping discounts, and other exclusive offers.

As one Tesco customer noted, “

Using my Tesco Bank All Round Credit Card and earning Clubcard points has been a game-changer for my grocery shopping. I love redeeming my points for vouchers that help me save even more.

“

The redemption process is simple: customers can log into their Tesco Clubcard account online or through the Tesco app to see their points balance and choose their preferred reward.

Customer Support and Assistance

Tesco Bank provides comprehensive customer support to its All Round Credit Card holders, ensuring that any queries or issues are addressed promptly.

Getting in Touch with Tesco Bank

Customers can contact Tesco Bank for inquiries or to report issues with their account through various channels. The bank’s customer support team is available to assist with any questions or concerns.

Managing Your Account Online

The online account management system allows customers to view their account details, track transactions, and make payments. This convenient feature enables cardholders to stay on top of their finances at any time.

Answers to Common Questions

Tesco Bank’s FAQ section provides answers to common questions about the All Round Credit Card, covering topics such as card usage, payments, and rewards. Customers can find helpful information and solutions to common issues.

By providing multiple channels for customer support, Tesco Bank ensures that its All Round Credit Card holders receive the assistance they need, making it easier to manage their accounts and enjoy the benefits of their card.

FAQ

What is the Tesco Bank All Round Credit Card’s Annual Percentage Rate (APR)?

Can I use my Tesco Bank All Round Credit Card for balance transfers?

How do I earn Tesco Clubcard points with my All Round Credit Card?

What are the fees associated with the Tesco Bank All Round Credit Card?

How can I manage my Tesco Bank All Round Credit Card account online?

What should I do if I have a query or concern about my Tesco Bank All Round Credit Card?

Can I redeem my Tesco Clubcard points for rewards?

What is the eligibility criteria for the Tesco Bank All Round Credit Card?

you will be redirected