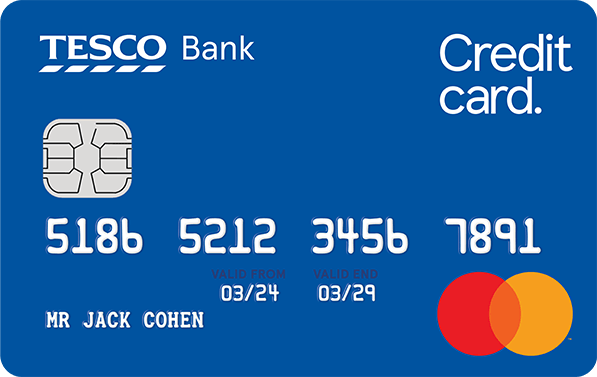

How To Apply for Tesco Bank All Round Credit Card

The Tesco Bank All Round Credit Card offers a fully online approval process, making it quick and easy to submit an application from the comfort of your own home.

This credit card provides numerous benefits, including 0% interest on purchases and balance transfers, as well as the opportunity to earn Clubcard points.

By applying online, applicants can enjoy a streamlined process that typically results in a quick decision regarding their application status.

Key Takeaways

- The Tesco Bank All Round Credit Card offers a fully online application process.

- Applicants can enjoy 0% interest on purchases and balance transfers.

- The card allows users to earn Clubcard points.

- The online application process is quick and easy.

- Applicants typically receive a decision on their application status promptly.

Overview of Tesco Bank’s All Round Credit Card

With its array of features and benefits, the Tesco Bank All Round Credit Card stands out in the market. This credit card is designed to offer a range of advantages to its users, making it a popular choice among UK residents.

Key Features of the All Round Credit Card

The Tesco Bank All Round Credit Card comes with several key features that make it an attractive option for potential applicants. Some of the notable features include:

- 0% interest on purchases for a promotional period

- 0% interest on balance transfers for a promotional period

- Earning Clubcard points on purchases

These features are designed to provide cardholders with flexibility and rewards, making the Tesco Bank All Round Credit Card a versatile financial tool.

| Feature | Benefit |

|---|---|

| 0% interest on purchases | No interest charged on purchases for a promotional period |

| 0% interest on balance transfers | No interest charged on balance transfers for a promotional period |

| Clubcard points | Earn points on purchases, redeemable for rewards |

Eligibility Criteria for Applicants

To be eligible for the Tesco Bank All Round Credit Card, applicants must meet certain criteria. These include:

- Being a UK resident

- Being aged 18 or over

- Meeting specific credit criteria

Applicants who meet these eligibility criteria can proceed with their application, either online or through other available channels.

Benefits of Online Application

Applying online for the Tesco Bank All Round Credit Card offers several benefits, including:

- Quick approval

- Ease of use

- Ability to track application status online

The online application process is designed to be straightforward and efficient, allowing applicants to complete their application quickly and easily.

Step-by-Step Guide to the Application Process

Before starting your application for the Tesco Bank All Round Credit Card, it’s essential to understand the process. This will help you prepare the necessary information and documents, ensuring a smooth and efficient application.

Preparing Necessary Documentation

To apply for the Tesco Bank All Round Credit Card, you’ll need to provide certain documents and information. These typically include:

- Personal identification, such as a valid passport or driving licence

- Proof of address, like a utility bill or bank statement

- Income details, including payslips or a P60 form

Having these documents ready will help you complete the application form accurately and quickly.

Completing the Online Application Form

The online application form is designed to be user-friendly and straightforward. You’ll need to provide personal and financial information, including:

- Your name, address, and contact details

- Employment status and income information

- Details of your financial commitments, such as other loans or credit cards

It’s crucial to ensure that the information you provide is accurate and up-to-date to avoid any delays in processing your application.

What to Expect After Submission

Once you’ve submitted your application, Tesco Bank will review it and make a decision regarding your credit card application. You can expect:

- A decision on your application within a few days

- Notification of the outcome via email or post

- If approved, details about your credit limit, interest rate, and repayment terms

If your application is successful, you’ll receive your Tesco Bank All Round Credit Card in the post, along with information on how to activate it and start using it.

Tips for a Successful Credit Card Application

A successful credit card application requires careful planning and attention to detail. Applicants should be aware of the common pitfalls that can lead to rejection.

Common Pitfalls to Avoid

One of the most significant factors affecting a credit card application is the applicant’s credit history. To avoid common mistakes, ensure all credit accounts are up to date and be cautious with credit utilization ratios.

The Importance of Credit Scores

Credit scores play a crucial role in determining the success of a credit card application. Understanding how credit scores are calculated and maintaining a healthy score can significantly improve the chances of approval for the Tesco Bank All Round Credit Card.

Managing Finances After Approval

After being approved for the Tesco Bank All Round Credit Card, it is essential to manage finances effectively. This includes making timely payments and keeping credit utilization ratios low to avoid negatively impacting the credit score.

By following these tips, applicants can ensure a successful credit card application and enjoy the benefits of their Tesco Bank All Round Credit Card while maintaining a good credit history.

FAQ

What is the Tesco Bank All Round Credit Card?

What are the eligibility criteria for the Tesco Bank All Round Credit Card?

How do I apply for the Tesco Bank All Round Credit Card?

What are the benefits of applying online for the Tesco Bank All Round Credit Card?

What is the interest rate on the Tesco Bank All Round Credit Card?

How can I ensure a successful credit card application?

What information do I need to provide when applying for the Tesco Bank All Round Credit Card?

How long does it take to receive a decision on my application?

How can I manage my finances effectively after being approved for the Tesco Bank All Round Credit Card?

What is the importance of understanding credit scores?

Tesco Bank All Round Credit Card

- 0% interest on purchases

- 0% interest on money transfers

- Collect extra Clubcard points with your Clubcard Credit Card

you will be redirected